[big_title small_margin=”no”]

What is Coinsurance?

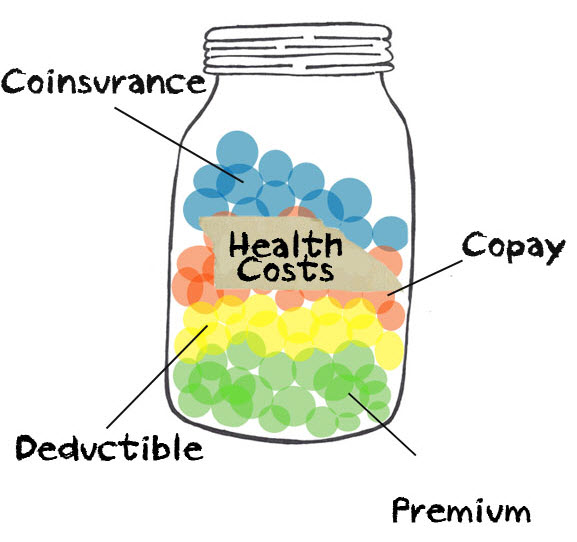

The percentage of Covered Medical Expenses that company pays in other words percentage of the claim divided between the insured and the insurance company

[/big_title]

[big_title small_margin=”no”]

What is Copayment/Copay?

A specified dollar amount that the insured is required to pay for certain Covered Medical Expenses

[/big_title]

Covered Medical Expenses: reasonable charges which are:

- not in excess of Usual and Customary Charges

- not in excess of the Preferred Allowance when the policy includes Preferred Provider benefits and the charges are received from a Preferred Provider

- not in excess of the maximum benefit amount payable per service as specified in the Schedule of Benefits

- made for services and supplies not excluded under the policy

- made for services and supplies which are a Medical Necessity

- made for services included in the Schedule of Benefits; and 7) in excess of the amount stated as a Deductible, if any

Deductible: if an amount is stated in the Schedule of Benefits or any endorsement to this policy as a deductible, it shall mean an amount to be subtracted from the amount or amounts otherwise payable as Covered Medical Expenses before payment of any benefit is made. The deductible will apply as specified in the Schedule of Benefits.

Inpatient: an uninterrupted confinement that follows formal admission to a Hospital by reason of an Injury or Sickness for which benefits are payable under this policy

Out of Pocket Maximum(OOPM): the amount of Covered Medical Expenses that must be paid by the Insured Person before

Covered Medial Expenses will be paid at 100% for the remainder of the Policy Year according to the policy Schedule of Benefits. The following expenses do not apply toward meeting the Out-of-Pocket Maximum, unless otherwise specified in the policy Schedule of Benefits:

- Deductibles

- Copays

- Expenses that are not Covered Medical Expenses

Preferred Providers: are the Physicians, Hospitals and other health care providers who have contracted to provide specific

medical care at negotiated prices. Preferred Providers in the local school area are: United Healthcare Options PPO (Preferred Provider Operators)

Preferred Allowance: the amount a Preferred Provider will accept as payment in full for Covered Medical Expenses

Preventive Care Services: Preventive care lets your doctor find potential health problems BEFORE you feel sick. Preventive care can include immunizations, lab tests, physical exams and prescriptions. Diagnostic services help your doctor understand your symptoms or diagnose your illness.

Out of Network/Non-Preferred Provider: providers have not agreed to any prearranged fee schedules. Insureds may incur significant out-of-pocket expenses with these providers. Charges in excess of insurance payment are the insured’s responsibility

Network Area: the 50 miles radius around the local school campus the Named Insured is attending